kansas sales tax exemption form pdf

Street RR or P. You can find resale certificates for other states here.

Kansas Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

Ad Download or Email MTC Sales Tax Cert More Fillable Forms Register and Subscribe Now.

. For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates located at. Businesses with a general understanding of Kansas sales tax rules and regulations can avoid costly errors. Is exempt from Kansas sales and compensating use tax for the following reason.

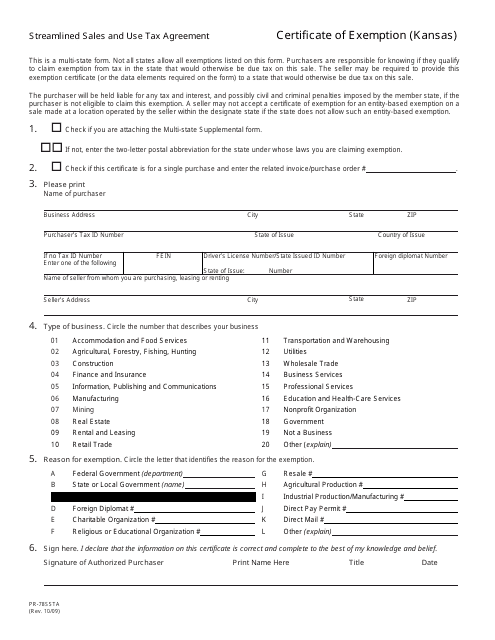

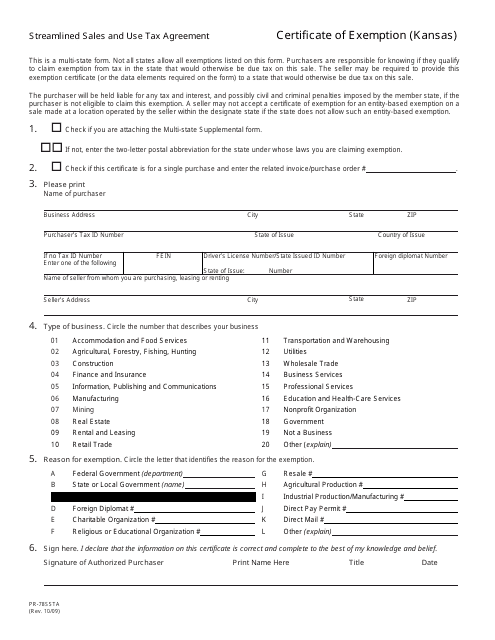

Download or print completed PDF. This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax AgreementPlease note that Kansas may have specific restrictions on how exactly this form can be used. Sign the form using our drawing tool.

1 Addition to Exemption Application Vehicles Form or 2 Addition to Exemption Application Active Military Personnel Vehicles Form 4. We have four Kansas sales tax exemption forms available for you to print or save as a PDF file. Please complete one of the following forms.

If personal property where. Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory. 79-3606k WHEN ALL THREE 3 OF THE FOLLOWING ARE MET.

This sales tax exemption is in the Kansas Department of Revenues Notice 00-08 Kansas Exemption for Manufacturing Machinery Equipment as Expanded by KSA. HOWEVER if the inventory item purchased by an out-of-state retailer who has sales tax nexus with Kan sas is drop shipped to a Kansas location the out-of-state retailer must. The purchaser is a bona fide resident of a state other than Kansas 2.

Revenues basic sales tax publication KS-1510 Kansas Sales and Compensating Use Tax. _____ Applicant Name Owner of Record. Streamlined Sales Tax Certificate of Exemption.

Kansas Sales Tax and Compensating Use Tax. The certificate is to be presented by tax exempt entities to retailers to purchase goods andor services tax exempt from sales and use tax. This notice is available by calling 785-368-8222 or from our web site.

Only those businesses and organizations that are registered to collect Kansas sales tax and provide their Kansas sales tax registration number on this form may use it to purchase inventory without tax. The certificates will need to be renewed on the departments website. Street RR or P.

Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory. Ov for additional information. Kansas Sales Use Tax for the Agricultural Industry at.

The new certificates have an expiration date of October 1 2020. Send to someone else to fill in. BEFORE THE BOARD OF TAX APPEALS OF THE STATE OF KANSAS TAX EXEMPTION KSA.

Sales and Use Tax Entity Exemption Certificate. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. Fill in your choosen form.

Ad KS Affidavit of Exempt Status More Fillable Forms Register and Subscribe Now. If any of these links are broken or you cant find the form you need please let us know. And Publication KS-1520 Kansas Exemption Certificates located at.

Fill has a huge library of thousands of forms all set up to be filled in easily and signed. For additional information see Publication KS-1520 DQVDV HPSWLRQ HUWLFDWHV. For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates located at.

_____ Business Name. This booklet is designed to help businesses properly use Kansas sales and use tax exemption certificates as buyers and as sellers. The following entities and organizations are exempt and issued a Tax Exempt Entity Certificate from the Kansas Department of Revenue.

Sales Tax Entity Exemption Certificate Renewal On November 1 2014 the sales tax exemption certificate issued by the Kansas Department of Revenue will expire. Questions would be directed to Taxpayer Assistance at. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from.

Box City State Zip 4. The motor vehicle semitrailer pole trailer or aircraft will be removed from Kansas within 10 days of purchase and. ST-28F Agricultural Exemption Certificate Rev 12-21 Author.

Printable Kansas Exemption Certificates. Other Kansas Sales Tax Certificates. Is exempt from Kansas sales and compensating use tax for the following reason.

Ad 79-201 Ninth More Fillable Forms Register and Subscribe Now. As a registered retailer or consumer you will receive updates from the Kansas Department of Revenue when changes are made in the laws governing sales and use tax exemptions. Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates located at.

Sellers should retain a. Tax Exemption TX TX Application Form 47k TX Addition 79-201 Ninth 19k Humanitarian Service Provider TX Addition 79-201 Seventh 13K Parsonage TX Addition 79-201b First 21k Hospitals TX Addition 79-201b Fourth 34k Low Income Housing TX Addition 79-201b Second Third Fifth andor Sixth 36k Adult. You may also obtain the.

KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or services purchased from. REQUIRED TO PAY KANSAS SALES TAX UNDER THE NONRESIDENT EXEMPTION PROVIDED FOR BY KSA. HOWEVER if the inventory item purchased by an out-of-state retailer who has sales tax nexus with Kansas is drop shipped to a Kansas location the out-of-state retailer must provide.

The renewal process will be available after June 16th. It explains the exemptions currently authorized by Kansas law and includes the exemption certificates to use. To apply for update and print a sales and use tax exemption certificate.

SalesTaxHandbook has an additional three. Fill in and edit forms. Keep these notices with this booklet for future reference.

Box City State Zip 4 _____ is exempt from Kansas sales and compensating use tax for the following reason.

Form St 8b Fillable Affidavit Of Delivery Of A Motor Vehicle Semitrailer Pole Trailer Or Aircraft To A Nonresident Of Kansas

Fillable Online Baldwincity Kansas Department Of Revenue Baldwincityorg Fax Email Print Pdffiller

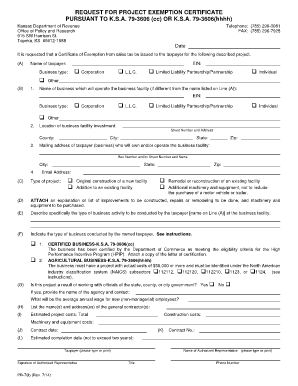

Pr 78 Fill Online Printable Fillable Blank Pdffiller

Form St 201 Download Fillable Pdf Or Fill Online Integrated Production Machinery And Equipment Exemption Certificate Kansas Templateroller

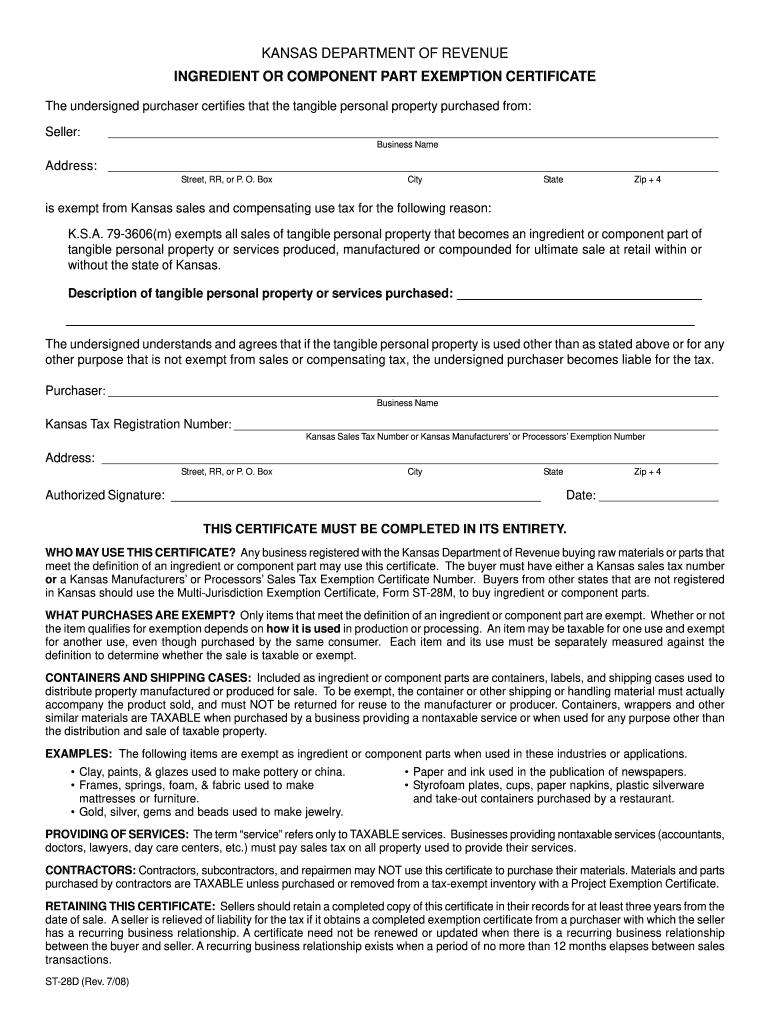

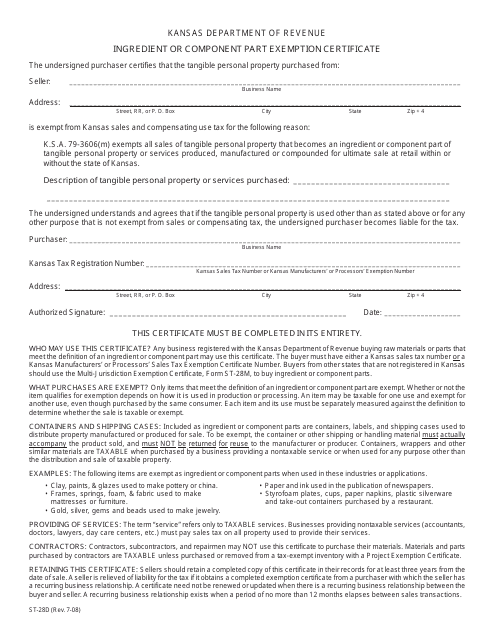

Ks St 28d 2008 2022 Fill Out Tax Template Online Us Legal Forms

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

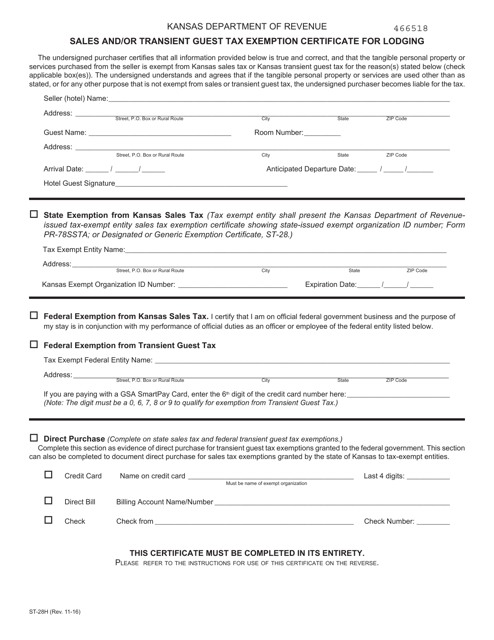

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

Philip Hardwidge Fill Online Printable Fillable Blank Pdffiller

Kansas Resale Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Form Pr 78ssta Download Fillable Pdf Or Fill Online Streamlined Sales And Use Tax Agreement Certificate Of Exemption Kansas Kansas Templateroller

Kansas Exemption Form Fill Out And Sign Printable Pdf Template Signnow